Leonardtown’s FY26 Budget

Deep Dive Into Key Items

Leonardtown’s FY2026 Approved Budget offers a roadmap of how the town government allocates resources to achieve its goals. From infrastructure projects to day-to-day services, this budget reflects planning designed to serve both current residents and future generations.

As the only municipality in St. Mary’s County, the town is governed by a Mayor and Town Council. These elected officials, voted on by residents in the town limits, undergo a similar budget process as the county government each year to allocate funding, set tax rates and fees, and approve capital improvement projects.

Here’s a breakdown of major points across revenue, expenditure, and capital improvement categories:

Revenue

The General Fund supports essential services like public safety, public works, parks, government operations, and community development. For FY2026, Leonardtown expects to collect $3.11M in General Fund revenues—a 15.9% increase over FY2025. Revenue sources include:

Income Taxes ($1.17M) - Income tax, at 38% of revenues, remains Leonardtown’s single largest source of operating revenue. The income tax rate, 3.2%, is collected by the State and returned via distribution payments to the Town.

Real Property Taxes ($870K) - Property taxes, at 28% of revenues, are the second largest revenue stream. Although the Town has kept the tax rate steady since FY2024, revenue increases due to rising property assessments and the addition of new homes and developments. Leonardtown’s property tax rate is $0.1203 per $100 of assessed home value, which is charged in addition to the St. Mary’s County property tax rate of $0.8478.

Highway User Revenue ($391K) - This state-provided funding supports street and road maintenance. After years of reductions, Maryland has restored HUR to near pre-2010 levels, and Leonardtown is now receiving a healthier share—providing support for local infrastructure.

Grants, Licenses, and Other Revenues ($552K) - Leonardtown also receives funding from a variety of grants and fees. These include arts council grants, waterway improvement grants, facade improvement funds, accommodation tax, and permit fees. Notably, the town is setting aside an additional $250,000 from prior-year fund balance to fund capital improvements like sidewalk utility relocation along Route 245.

Expenditures

The total General Fund expenditures for FY2026 are also $3.11M, reflecting a balanced budget. Major categories include:

Public Works ($878K) - The largest expenditure in the General Fund, Public Works handles everything from road maintenance and snow removal to stormwater management and street signage. This year’s budget includes:

$126K for road repairs

$100K for snow removal

$75K for storm drain and sidewalk work

$30K for new traffic calming measures on Fenwick Street

General Government ($786K) - This covers the administrative functions of the Town, including salaries, legal and accounting services, insurance, utilities, and IT support. A significant part of the increase this year is due to technology upgrades. When adding in debt service payments and transfers to capital projects from this account, the total expense climbs to $1.2M.

Community Development ($418K) - Funding supports Leonardtown’s public events, arts and entertainment programming, and downtown revitalization. It also includes support for the Main Street Program, facade improvement grants, and tourism-related projects. Examples of funded events and activities include:

Concerts on the Square

Veterans Day Parade

Moll Dyer Weekend

Christmas lights (under a 3-year contract)

Past events like Earth Day and Beach Party on the Square are not funded in this year's budget.

Planning & Zoning ($259K) - This department oversees land use, zoning enforcement, and development reviews. Primary expenses here are salary related.

Public Safety ($127K) - While Leonardtown doesn’t have its own police department, the budget supports law enforcement partnerships, fire and rescue squad grants, and new safety features like Wi-Fi-connected cameras and radar speed signs to monitor traffic and enhance pedestrian safety.

Recreation & Parks ($228K) - Continued investment in community spaces like the Wharf, Port of Leonardtown, and various pocket parks. The capital outlay includes:

New irrigation and sod for the Parkette

Interpretive signage for playgrounds

String lighting for public spaces

Camera installations for public safety

Capital Improvements

Leonardtown is planning over $11.5M in capital improvements between FY2026 and FY2030. The most urgent and significant projects begin this year:

Water Tower Construction ($7.4M) - This new 800,000-gallon storage tank is needed to meet the demand of new residential and commercial development. It is being funded through a combination of impact fees, a $5M loan, and grants.

New Water Well ($2.5M) - The Town will construct a new potable water well to ensure adequate water supply for the Phase 2 of the Meadows at Town Run neighborhood off Hollywood Road.

Water Meter Replacement Project ($700K) - Modern meters will improve water usage tracking and billing accuracy while enhancing operational efficiency.

Enterprise Fund: Water, Sewer & Trash Services

The Enterprise Fund is self-sustaining and does not use General Fund taxes. It’s funded entirely by service fees from residents and businesses. The FY2026 budget for the Enterprise Fund totals $5.78M.

Sewer and Wastewater ($3.06M) - This includes operations and debt service for the Enhanced Nutrient Removal (ENR) and Wastewater Treatment Plant (WWTP) expansion. Leonardtown partners with the St. Mary’s County Metcom, which shares 20.19% of the original $7.5M ENR debt. Due to increased operational costs and reduced reserves, sewer service rates will increase in FY2026 to maintain financial stability.

Water Services ($1.18M) - The water budget is slightly lower than last year’s, but the Town must now begin repayments on the new water infrastructure loans. As a result, water service rates will also increase.

Trash Collection ($1.54M) - A new 5-year contract with WB Waste Solutions takes effect on July 1, 2025, causing monthly trash bills to increase by $6.61.

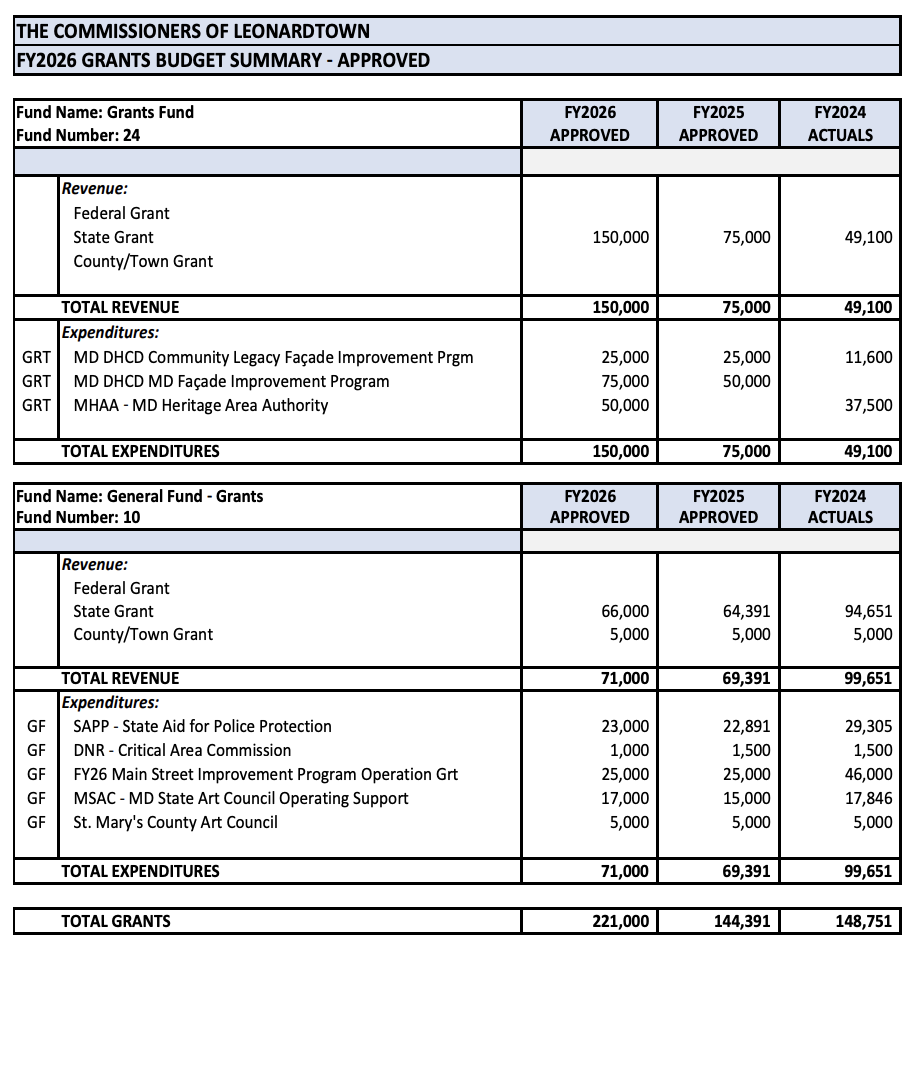

Grants

Leonardtown’s waterfront is a major focus area. The FY2026 budget includes a $34K commitment to this multi-year revitalization project. As of FY2025, the Town has committed over $509K to the waterfront and continues to seek outside grant funding and partnerships to advance the vision.

The Town is also actively leveraging state and federal grant programs, including:

Maryland DNR Critical Area Grants ($1K) - to fund Critical Area Program compliance efforts.

Maryland Heritage Areas Grant ($50K) - to cover planning/design for restoring the Town’s historic carousel, a vintage Allen Herschell over 100 years old which was used at the Leonardtown Fireman’s Carnival from 1942-2008.

Main Street Improvement Funds ($25K) - to partially fund a “Main Street Manager” position assisting with revitalization efforts.

Concert and Arts Grants ($17K) - to develop and promote “artistic and cultural” activities supporting tourism and economic income.

In summary, Leonardtown’s FY2026 budget balances essential services with strategic investments in infrastructure, public spaces, and economic development. By maintaining a stable tax rate while expanding revenue sources the Town is positioning itself to meet the demands of a growing population.