Governor Moore’s FY27 Budget

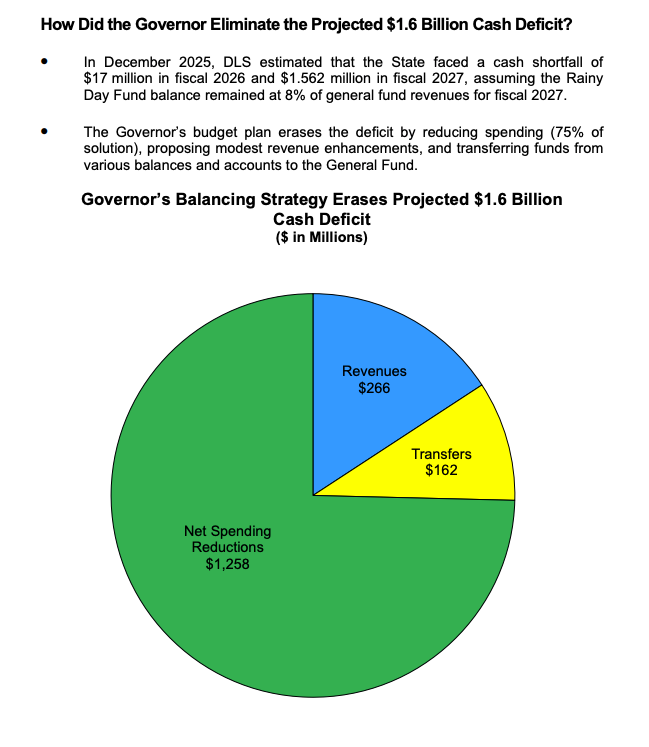

It is budget season in Annapolis as the General Assembly reviews Gov. Wes Moore’s proposed spending plan. Last month, Moore unveiled a $70.8 billion budget for fiscal year 2027 that closes an estimated $1.5 billion shortfall through cost shifts, fund reallocations and revisions to funding formulas. The Governor’s budget did not include any new taxes or fees.

Several issues stand out in the Department of Legislative Services’ fiscal briefing on the proposal.

First, DLS reports that spending in FY27 “exceeds ongoing revenues by $394 million.” While notable, the figure remains within the Spending Affordability Committee’s guideline of limiting the structural deficit to no more than $600 million.

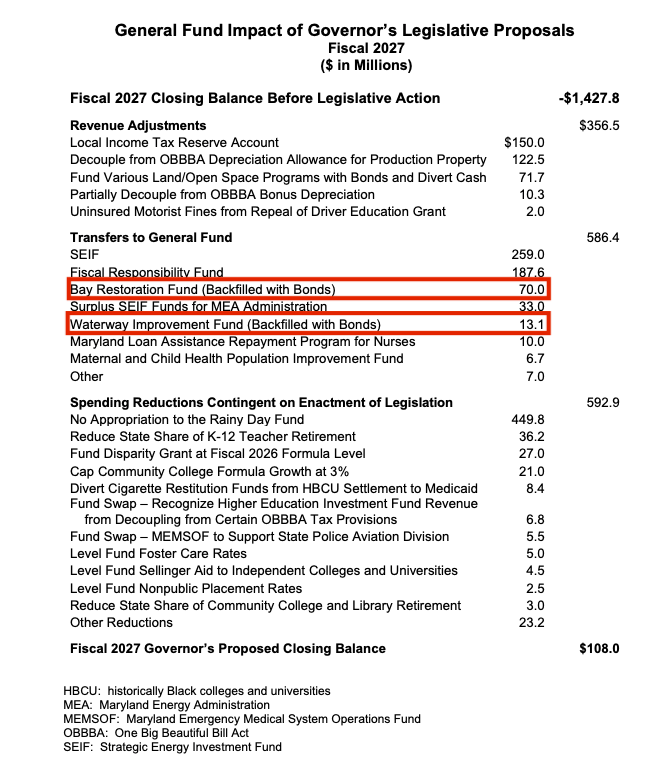

Second, the budget relies on debt to cover certain expenditures typically funded with cash. For example, the Bay Restoration Fund and the Waterway Improvement Fund are slated to receive $83 million, but that amount would be financed through bonds rather than cash. The approach frees up immediate revenue but shifts costs to taxpayers through long-term debt and interest payments.

Third, the proposal includes significant reductions to behavioral health and disability services, totaling approximately $170 million and $150 million, respectively. DLS warns these cuts will reduce service availability even as demand for mental health services has surged over the past two years. Some of the behavioral health reductions are tied to federal actions, with the Trump administration not extending certain grant programs while reducing funding for others. Maryland must either pick up the tab or discontinue supported programs.

Overall, about 75% of the structural deficit reduction comes from more than $1.2 billion in spending cuts across state government.

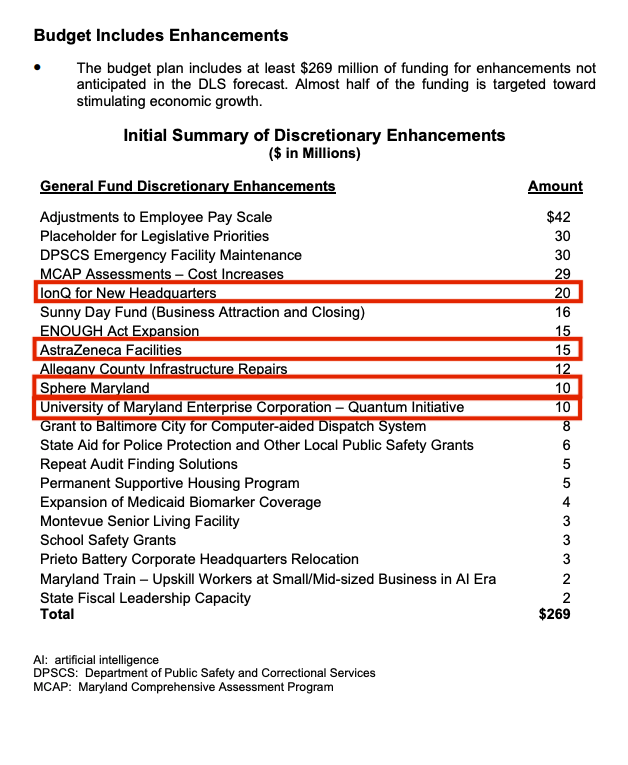

At the same time, the budget includes substantial targeted investments. About $269 million is allocated for “discretionary enhancements,” including $10 million for the Sphere Maryland project, $20 million for IonQ’s new headquarters and $10 million for IonQ’s partnership with the University of Maryland through the Quantum Computing Initiative. There’s also $15M for AstraZeneca Facilities. The state is subsidizing these projects in an effort to retain and attract high-paying jobs.

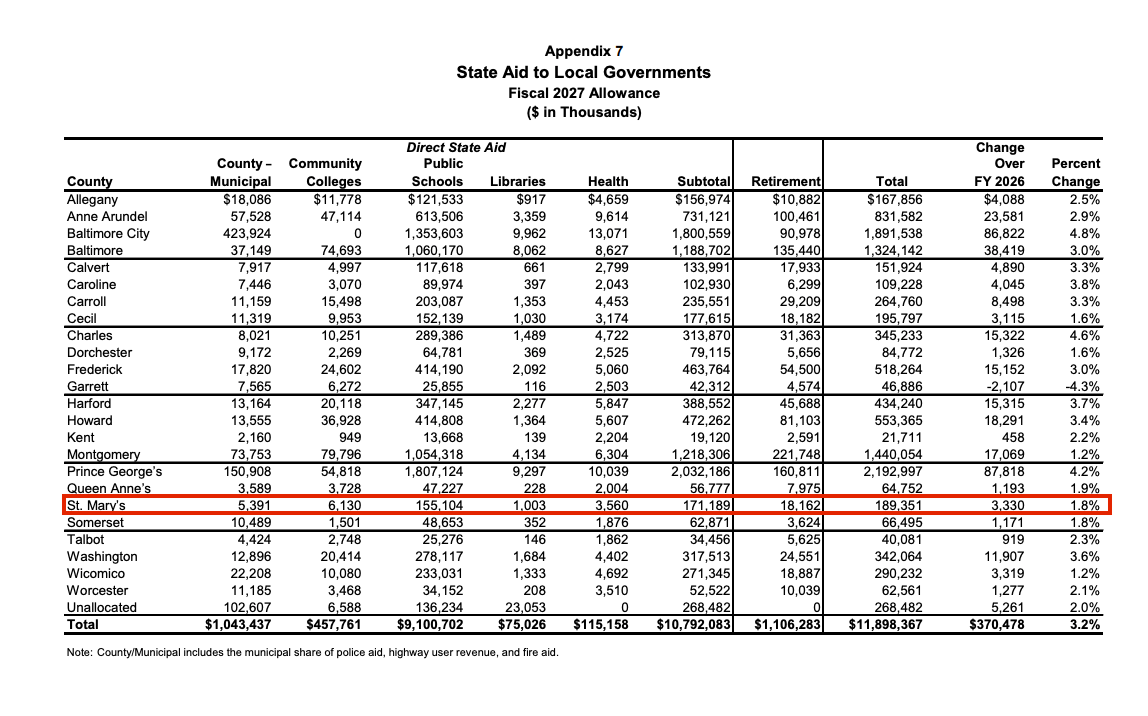

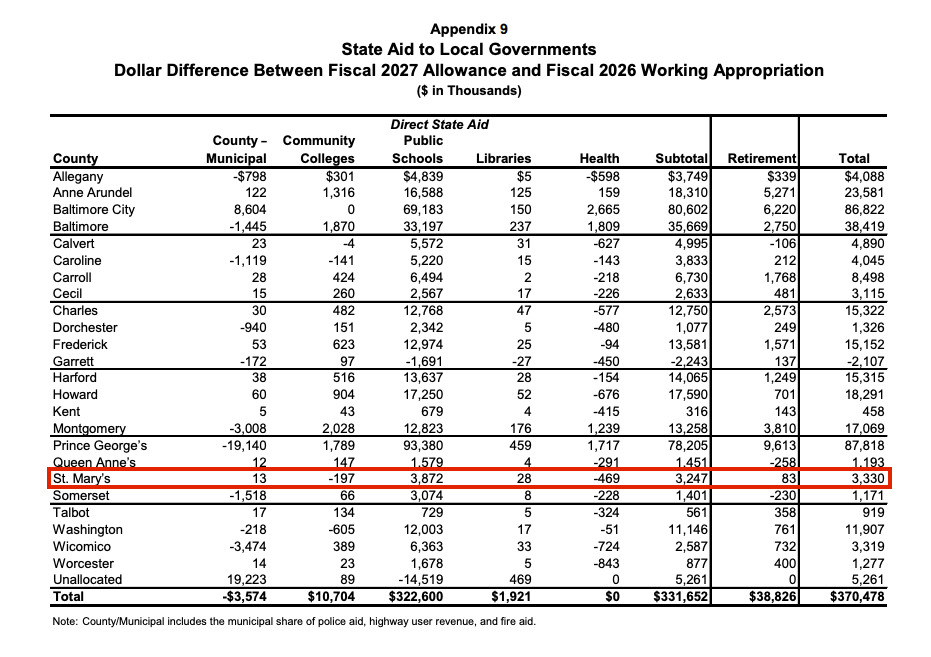

Moore’s proposal increases state aid to local governments by $380.8 million. The bulk of that funding — $359 million — is directed to public education. That includes $228 million from the Blueprint for Maryland’s Future Fund to hold school systems harmless from declining enrollment in the Free and Reduced Meals, or FARMs, program. Special education funding for public schools would increase by 17%, while funding for nonpublic special education programs would decrease by 16%. Funding for full-day prekindergarten would rise by 49%.

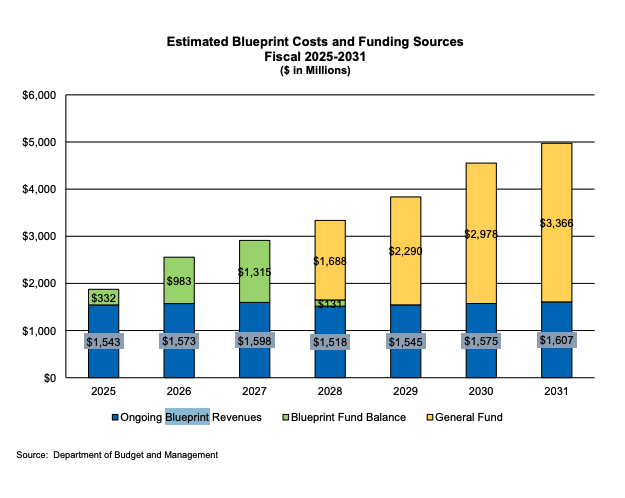

Looking ahead, Blueprint mandates continue to drive projected structural deficits in future years. Revenues dedicated to the Blueprint are expected to remain near $1.6 billion, while costs rise due to inflation, wages and increased service demand. As the Blueprint Fund balance declines, the General Fund is expected to shoulder a growing share of the cost, reaching more than $3.3 billion by 2031. Legislative action would be required to revise the Blueprint’s funding formulas to better align with local implementation realities. The General Assembly enacted the Blueprint in 2021 and adjusted its implementation timeline in 2022 and 2023.

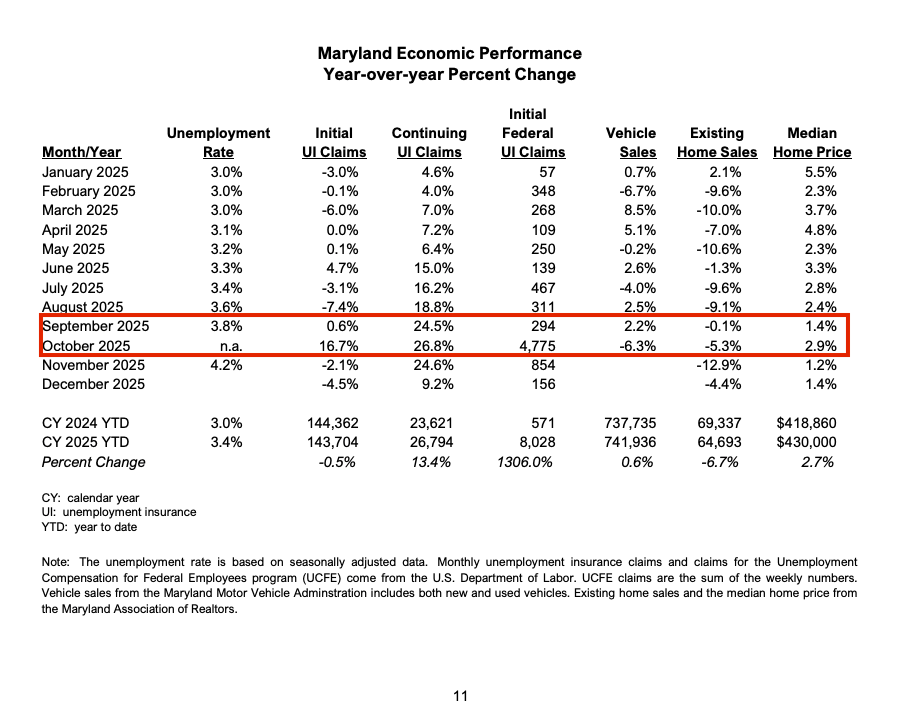

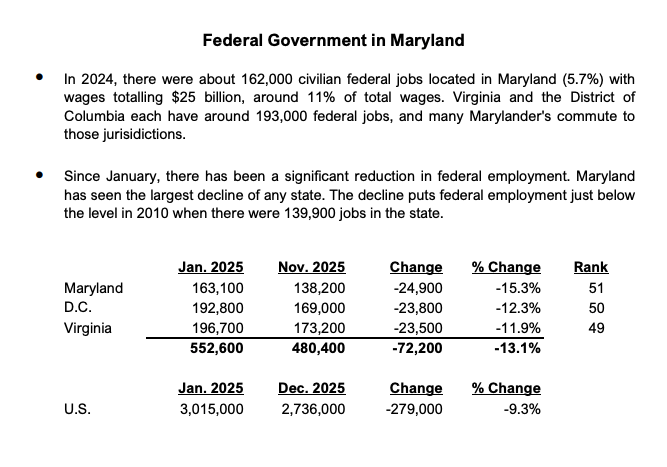

Maryland’s economy was heavily impacted by the Trump administration’s downsizing of the federal government. DLS’s report shows a 1500% increase in federal unemployment claims from September to October 2025. Wages from federal jobs totaled $25B in 2024, but from January to November 2025 nearly 25,000 jobs were lost in Maryland. That affects the amount of income tax revenue generated as well as spending activity in the state’s economy.

Additionally, $56 million is included in the budget to offset federal cost shifts related to SNAP and Medicaid enacted under the One Big Beautiful Bill Act last summer.

Impacts on St. Mary’s County

Many of the budget’s cost shifts fall directly on local governments, including St. Mary’s County, through the Budget Reconciliation and Financing Act, which accompanies the spending plan. The legislation makes changes to existing law to adjust mandated funding levels and reallocate responsibilities between the state and counties.

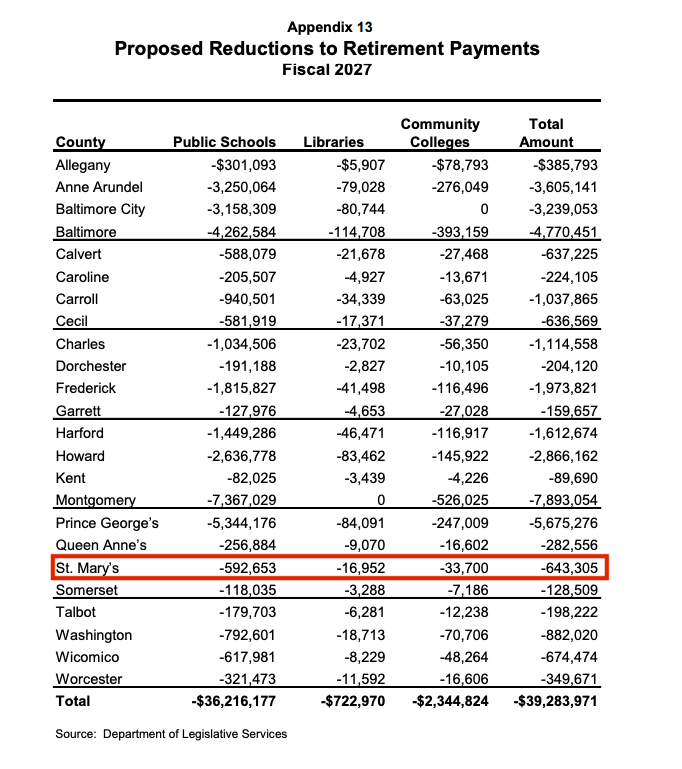

Under the proposal, counties statewide would be required to contribute an additional $39 million toward educator retirement benefits. St. Mary’s County’s share of that increase is projected to exceed $600,000, adding pressure to an already constrained local budget.

The BRFA also eliminates a $2 million statewide mandate administered by the Maryland State Department of Education to fund driver’s education programs in public high schools, shifting the burden to local school systems or potentially reducing access to those programs.

In Southern Maryland, the budget reduces funding for the Tri-County Council for Southern Maryland from $1 million to $700,000. The council supports regional economic development and workforce initiatives across St. Mary’s, Calvert and Charles counties, and the reduction could limit its capacity to coordinate projects critical to the region’s continued growth.

For St. Mary’s County, these changes translate into higher local costs, fewer state-supported programs and difficult tradeoffs as county officials prepare their own budgets amid continued population growth and service demand.