St. Mary’s Cannabis Funds

How Should $1.4 Million Be Spent?

When recreational cannabis was legalized in 2023, the Maryland legislature created the Community Repair & Reinvestment Fund (CRRF). A portion of the revenue generated from medical-to-recreational license conversions and the cannabis sales tax is designated for the fund, which directs money to areas most affected by cannabis charges. To date, St. Mary’s County has received more than $1.4 million, and the Commissioners are now deciding how to move forward with spending it.

Questions have circulated on social media about when—and how—the Commissioners would engage in a process to disperse these funds. Other Maryland counties, including Calvert and Charles, have already issued grants using CRRF money. On January 27, Deputy County Attorney John Houser briefed the Commissioners on the status of the fund. Houser explained that the Office of Social Equity (OSE), the state body that regulates the funding, has been delayed in releasing regulations clarifying allowable uses. Despite repeated requests, Houser said, the regulations were still not available.

According to a memo prepared by Houser, St. Mary’s County has received a total of $1,430,067.26 from the CRRF. Of that amount, $989,603.19 came from license conversion fees. “This revenue source will not be recurring; the last conversion fee installment was received on February 20, 2025,” the memo states. The county is expected to receive roughly $240,000 per year from cannabis sales tax revenue through 2033, when the current allocation guidelines sunset.

Other counties have taken different approaches to administering the funds. Some have created local commissions to oversee the process, while others have held public forums to solicit community input. State law requires each jurisdiction to pass an ordinance implementing a process and, beginning October 1, 2026, report to the OSE information related to both the allocation process and funding decisions.

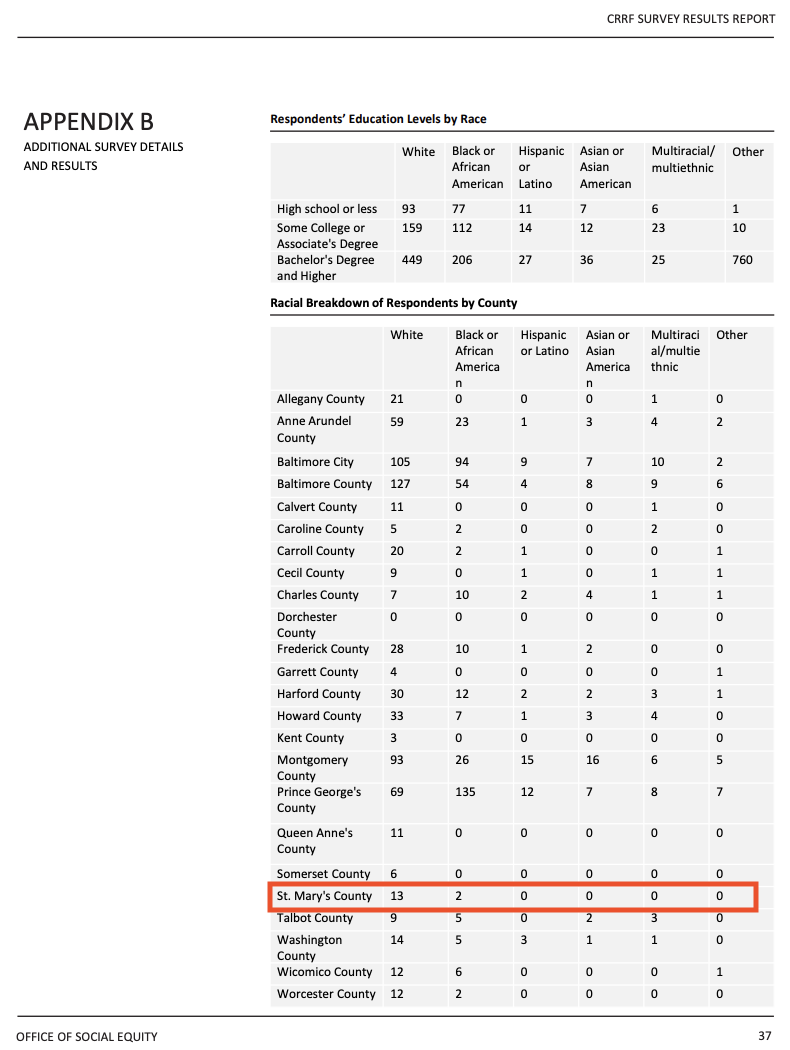

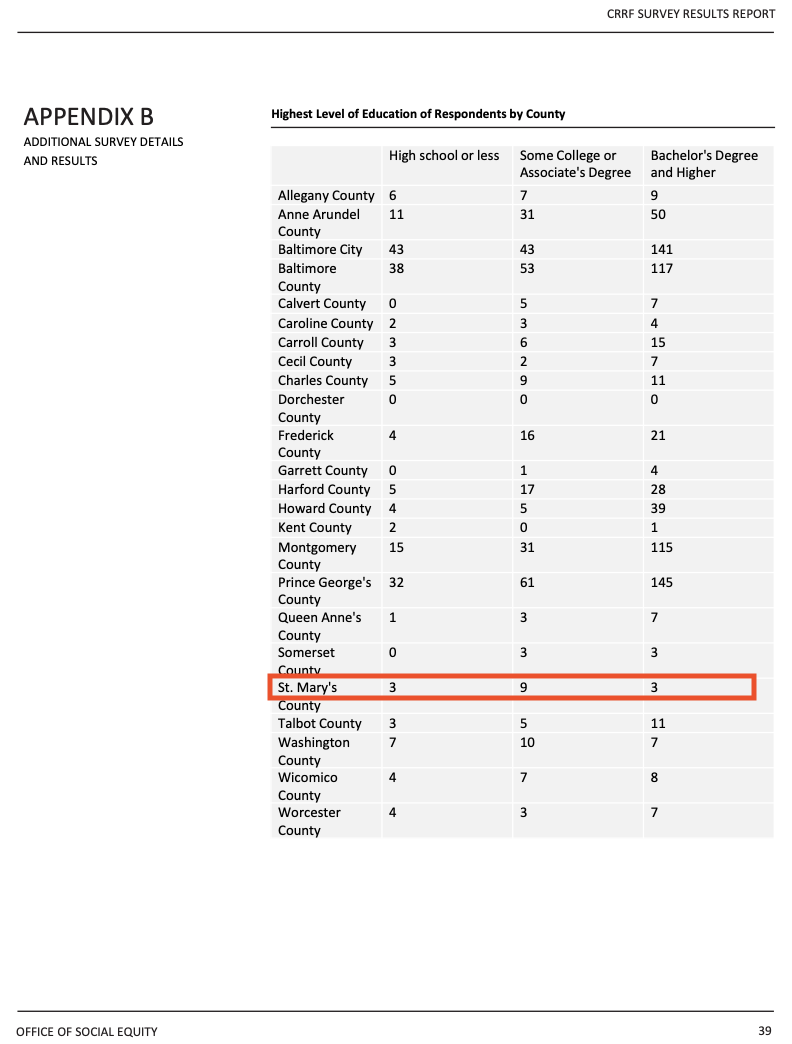

The OSE issued surveys in 2023 and 2024, asking local governments to disseminate to their constituents. Just one percent of respondents to both surveys were St. Mary’s County residents. St. Mary’s has a population of approximately 115,000, but detailed survey results indicate only fifteen people participated.

The Commissioners generally agreed that they need to move forward with creating a process. Commissioner Hewitt suggested handling CRRF funding alongside the county’s regular budget process for nonprofit grants. Under that framework, nonprofits submit applications to designated county departments, where staff score proposals and make recommendations to the Commissioners. Commissioner Colvin, however, argued that the process should occur sooner than—and separate from—the annual budget. He also said final decision-making authority should remain with the Commissioners rather than an independent commission.

State law identifies two primary purposes for which CRRF funding may be used: benefiting low-income neighborhoods through community initiatives addressing health, education, transportation, employment, or homelessness services; and investing in areas designated by the State as “disproportionately impacted areas…that had above 150% of the State’s 10-year average for cannabis possession charges,” according to Houser’s memo. In St. Mary’s County, only one area meets the latter definition: zip code 20653, which includes Lexington Park. From 2002 to 2023 more than 3,500 charges took place in Lexington Park according to State data.

One unresolved issue is how to define “low-income,” a term the State has not yet clarified. Several Commissioners asked Houser whether the county could define it locally. Commissioner Alderson cited a neighborhood in his district that could benefit from infrastructure funding. Alderson represents District 3, which stretches from Abell to Golden Beach. In one private community—where the county does not maintain roads—bus drivers and first responders have raised concerns about road conditions. Alderson believes the neighborhood would qualify as low-income. Houser said the Commissioners could adopt a local definition, but it could be overridden if the State later issues its own regulations.

Commissioner Colvin suggested prioritizing larger projects to get a “bigger bang for the buck,” emphasizing that low-income areas exist throughout the county, not just in Lexington Park. Commissioner Ostrow, who represents Lexington Park, agreed with that sentiment.

This was not the first time the Commissioners raised the issue. The last substantive discussion occurred roughly a year earlier. On February 10, 2025, Commissioner Hewitt initially suggested using the funds for snow removal before learning about the State-imposed limitations. Two weeks later, on February 25, Hewitt proposed that the St. Mary’s County Community Development Corporation administer the funds. During that discussion, Commissioner Alderson first suggested looking beyond Lexington Park, referencing the Longview Beach neighborhood in his district—the same area he alluded to during the January 2026 meeting.

By April 2025, Commissioner Hewitt was asking whether the YMCA would qualify as an appropriate use of CRRF funding. At the time, the YMCA was approximately $1.2 million short of its $22 million fundraising goal.

At the Commissioners’ direction, Houser will draft an ordinance for review at the next meeting on February 10, 2026. Commissioner Alderson underscored the urgency, noting that while “we’re waiting for the state” to provide guidance, the Commissioners have also said they are “tired of the state usurping local authority.”

___________

Informed St. Mary’s remains paywall free for everyone with your support. Donate here to support this important work.